In the rapidly evolving gig economy, freelancers are becoming a significant portion of the workforce. As of 2024, freelancers need to be more astute than ever with their financial management.

Here are essential tips, accompanied by specific images to illustrate each point vividly.

1. Establish a Solid Financial Foundation

Start by creating a separate bank account for your business to keep personal and professional finances distinct. This separation simplifies tax preparation and helps in monitoring business expenses and income more effectively.

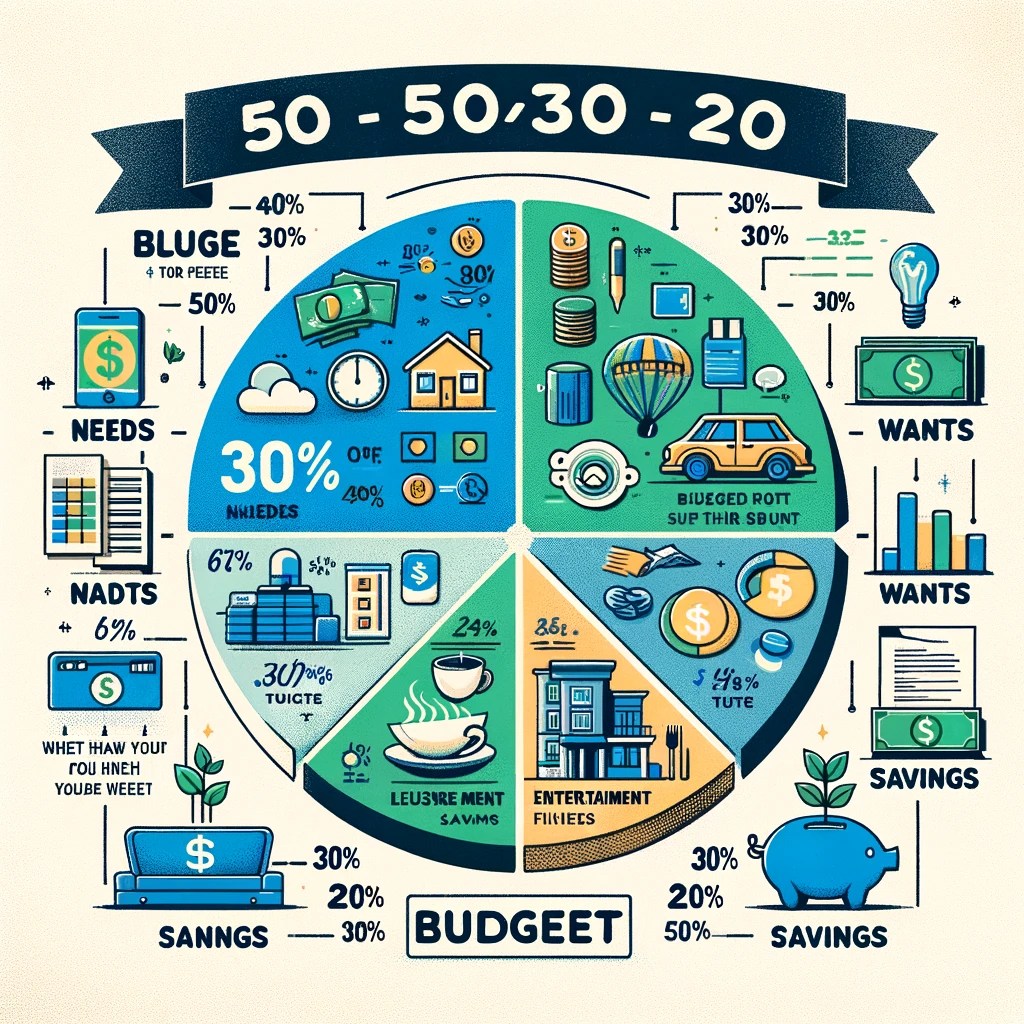

2. Embrace a 50/30/20 Budget Plan

Allocate your income wisely. Spend 50% on needs (bills, groceries), 30% on wants (leisure, hobbies), and save the remaining 20%. This balanced approach ensures you cover all bases—living, enjoyment, and future security.

3. Emergency Fund is Crucial

As income can be irregular, aim to save at least six months’ worth of living expenses. This fund acts as a buffer against unexpected downturns or emergencies, providing peace of mind and financial stability.

4. Invest in Retirement Early

Don’t neglect your future. Start contributing to a retirement plan early, taking advantage of compounding interest over time. Whether it’s an IRA or a Solo 401(k), ensure you’re setting aside a portion of your earnings for retirement.

5. Stay on Top of Taxes

Freelancers are responsible for their own taxes, including self-employment tax. Utilize accounting software to track income and expenses, and make quarterly estimated tax payments to avoid any surprises come tax season.

6. Invest in Your Growth

Set aside funds to invest in courses, certifications, or equipment that can enhance your skills and services. Continuous learning and upgrading not only increase your value but can also lead to higher earnings.

7. Use Financial Tools Wisely

Leverage technology to streamline your finances. Use budgeting apps to monitor your spending, invoicing software to bill clients promptly, and financial tracking tools to keep an eye on your business’s health.

8. Protect Yourself with Insurance

Insurance is not an area to skimp on. Health, disability, and professional liability insurance can protect you from significant financial losses due to illness, accidents, or legal issues.

9. Build a Strong Network

Networking is vital in freelancing. It can lead to new opportunities, collaborations, and support systems. Attend industry events, join online forums, and connect with peers to build a robust professional network.

10. Plan for Slow Periods

Fluctuations in workload are common. During busy periods, save aggressively to cushion against slower months. Additionally, diversifying your client base can help stabilize income.

Conclusion

Freelancing in 2024 demands financial savvy and discipline. By adopting these tips and integrating them into your daily routine, you can secure your financial well-being and focus on what you do best—delivering exceptional freelance work. With the right strategies in place, freelancers can navigate the uncertainties of gig work and build a prosperous, fulfilling career.

These tips, when implemented, can transform the financial landscape of any freelancer in 2024, ensuring not just survival but a thriving, robust career built on sound financial practices.

Leave a comment