In the ever-evolving world of finance, cryptocurrency has emerged as a groundbreaking innovation. But for many, it remains shrouded in mystery. Let’s demystify this digital currency and explore its intricacies.

What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security, making it nearly impossible to counterfeit. Unlike traditional currencies issued by governments (like the dollar or euro), cryptocurrencies operate on a decentralized system using blockchain technology.

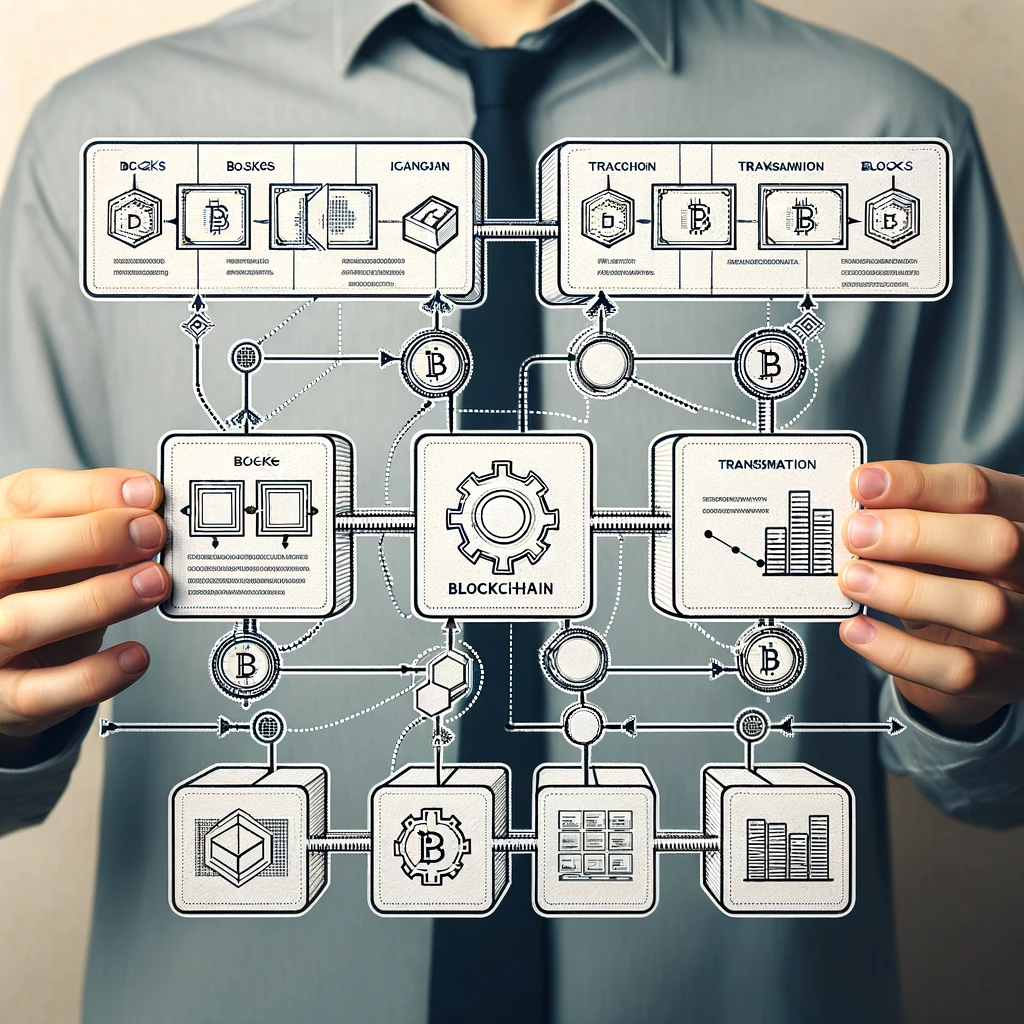

The Blockchain Revolution

Blockchain is the backbone of cryptocurrency. Think of it as a digital ledger where all transactions are recorded and verified by a network of computers. This decentralization makes it resistant to control or manipulation by any single entity.

Popular Cryptocurrencies

Bitcoin, the first and most well-known cryptocurrency, sparked the rise of thousands of alternatives, known as altcoins. Ethereum, Ripple, Litecoin, and Cardano are just a few examples. Each has unique features and uses.

How to Buy and Store Cryptocurrency

Purchasing cryptocurrencies is done via exchanges like Coinbase, Binance, or Kraken. You’ll need to set up an account, verify your identity, and link a payment method. Once purchased, store your digital assets in a digital wallet – either online, on your computer, or on a hardware wallet for added security.

Tips and Tricks for Beginners

- Research Thoroughly: Understand the currency you’re investing in.

- Start Small: Begin with a small investment to get a feel for the market.

- Use Secure Networks: Always conduct transactions over secure, private networks.

- Keep Your Wallet Secure: Use strong passwords and consider offline storage for larger amounts.

- Stay Informed: The cryptocurrency world changes rapidly. Stay up-to-date with market trends.

Understanding the Risks

Cryptocurrency investments come with risks. Prices can be highly volatile, and regulatory changes can impact the market. Always invest what you can afford to lose.

The Future of Cryptocurrency

Cryptocurrencies are more than just a financial fad. They represent a shift towards a more decentralized and transparent financial system. As technology advances, we can expect more integration into everyday financial dealings.

Conclusion

While cryptocurrencies present new opportunities, they also require a new understanding of financial systems. By staying informed and cautious, you can navigate this exciting digital landscape.

Leave a comment